Your Tax Bill Explained

UNDERSTANDING YOUR TAX BILL

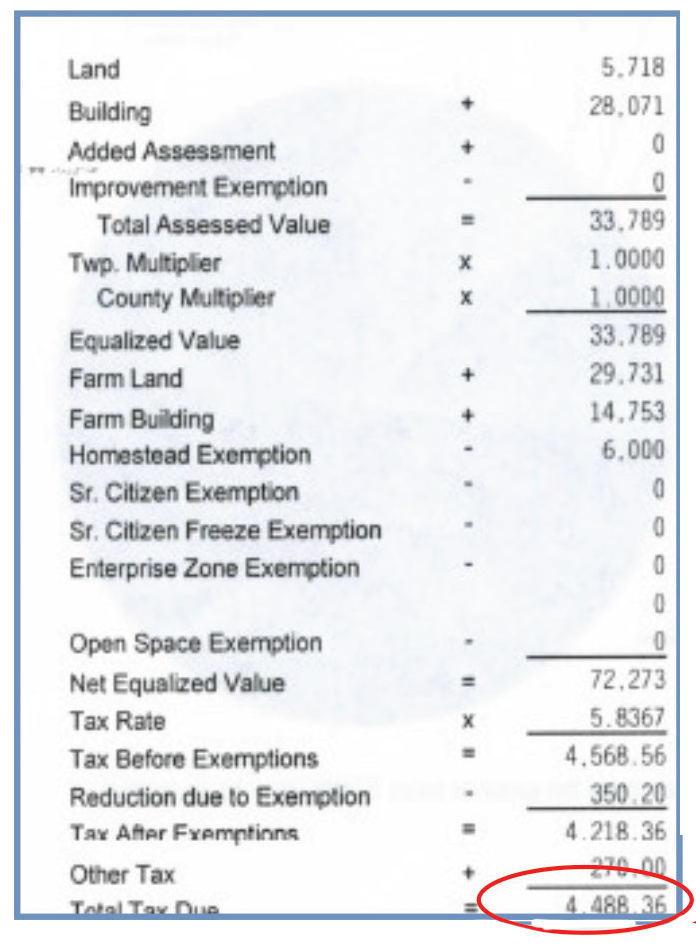

Your property tax bill is determined by two things – a property’s equalized assessed value (its share of the total tax base) and the applicable tax rates, which depend on the level of spending of local taxing districts. The assessed value is determined by local township assessors, who determine the market value of your home. This value is based on many factors, including your property characteristics, current sales of like homes in your area, and a sales ratio study that takes the three previous years’ sales into account. Generally, your assessment is determined by taking one-third of your market value and subtracting any exemptions to which you may be entitled. Tax rates are set by local government bodies that levy dollars. The amount of dollars levied by a taxing district depends on its budget.

TERMS YOU SHOULD KNOW

Equalization Factor: the factor that must be applied to local assessments to bring about the percentage of increase or decrease that will result in an equalized assessed value equal to one-third of the market value of taxable property in a jurisdiction.

Tax Code: a number used by the county clerk that refers to a specific combination of taxing bodies. Tax Rate: the amount of tax due stated in terms of a percentage of the tax base within a certain tax code.

Exemption: a reduction in the assessed value of a property. Will County offers many exemptions, including a general homestead exemptions and exemptions for senior citizens, veterans, and disabled persons.

Levy: the amount of money a taxing body certifies to be raised from the property tax.

Market Value: the most probable sale price of a property in a competitive and open market, assuming that the buyer and seller are acting prudently and knowledgeably, allowing sufficient time for the sale, and assuming that the transaction is not affected by undue pressures.

Taxing Body/Taxing District: a local governmental unit that levies a property tax. Taxing districts include school districts, park districts, fire protection districts, and municipalities, among others.

Total Assessed Value (Tax Base): the sum of all real property within a taxing district.

Equalized Assessed Value: the assessed value multiplied by the state-certified equalization factor. Tax bills are calculated by multiplying the equalized assessed value minus any exemptions by the tax rate.